Start Maximizing Savings with USDA loan refinance for Qualified Homeowners.

Start Maximizing Savings with USDA loan refinance for Qualified Homeowners.

Blog Article

Change Your Finances: Top Tips for Effective Lending Refinance

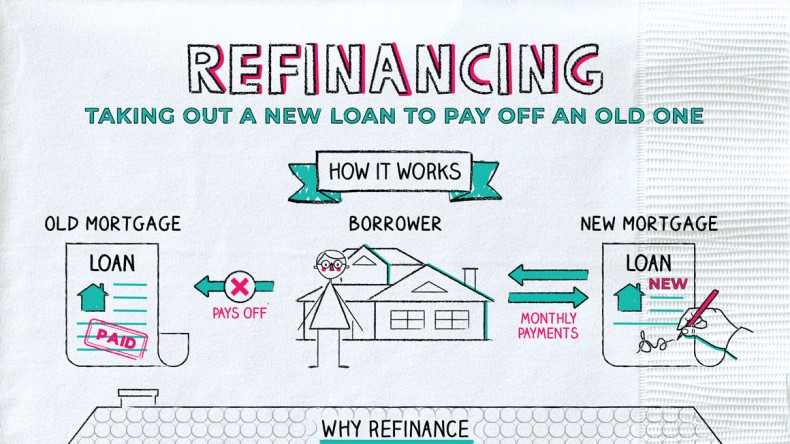

Effective funding refinancing can serve as a critical method in changing your monetary landscape. By understanding the subtleties of your present finances and examining your credit rating, you can position on your own to secure extra positive terms. With a huge selection of re-financing alternatives readily available, it comes to be important to perform thorough study and compute potential financial savings thoroughly. However, several forget critical documents that can dramatically influence the outcome of this procedure. As we check out these foundational steps, you might discover that the path to financial enhancement is more obtainable than you expected.

Understand Your Present Fundings

Before getting started on the finance refinance journey, it is necessary to perform a comprehensive analysis of your existing fundings. Comprehending the specifics of your existing loans, including rate of interest, terms, and impressive equilibriums, is crucial for making informed decisions. Begin by compiling a full listing of your loans, noting the kind-- be it a home loan, automobile lending, or pupil financing-- along with the lending institution details.

Pay special interest to the rates of interest related to each car loan. High-interest loans can profit considerably from refinancing, as securing a lower rate can result in considerable savings with time. Additionally, think about the regards to your financings; those with longer repayment periods might have lower regular monthly settlements but can accrue even more passion in time.

It is also vital to recognize any prepayment fines or costs associated with your current financings. By meticulously reviewing your existing finances, you can identify whether refinancing lines up with your economic objectives and establish a clear strategy for moving forward in the refinancing procedure.

Evaluate Your Credit Rating

A strong understanding of your credit rating is crucial when taking into consideration lending refinancing, as it dramatically affects the interest rates and terms loan providers want to supply. Credit rating normally vary from 300 to 850, with greater ratings suggesting much better credit reliability. Prior to starting the refinancing process, it is essential to assess your credit report for any type of mistakes that might negatively impact your score.

If your score is below the optimum variety (usually considered to be 700 or over), take into consideration taking steps to improve it before applying for refinancing. This may consist of paying for existing financial debt, making timely settlements, or contesting any inaccuracies. A higher credit history can cause a lot more desirable refinancing terms, ultimately conserving you cash in the future.

Research Study Refinance Options

Checking out numerous refinance choices is essential for protecting the finest possible terms for your loan. Each alternative offers distinct functions, whether you intend to reduce your interest price, gain access to equity, or streamline your existing funding advice terms.

Next, recognize potential loan providers, consisting of traditional banks, lending institution, and on-line home mortgage firms. Research study their offerings, rate of this website interest, and costs, as these can differ significantly. It is important to read consumer testimonials and examine their credibility with regulatory bodies to assess dependability and client service.

Additionally, take official site into consideration the loan terms supplied by different loan providers, including the size of the lending, dealt with vs. adjustable prices, and connected closing costs. Gathering this details will empower you to make informed choices and bargain far better terms.

Finally, bear in mind current market patterns and financial indicators, as they can affect rates of interest. By completely looking into refinance choices, you position on your own to optimize your economic outcomes and accomplish your refinancing goals successfully.

Calculate Potential Savings

Computing potential savings is a critical action in the refinancing procedure, permitting customers to examine whether the benefits surpass the prices. To begin, identify your current finance terms, including rate of interest rate, month-to-month settlement, and remaining balance. Next off, get quotes for brand-new loan terms from different loan providers to contrast rate of interest and associated fees.

Once you have this information, use a car loan calculator to estimate your new month-to-month settlement based upon the suggested rates of interest and financing quantity. Subtract this number from your present regular monthly repayment to determine your potential savings each month.

Don't neglect to aspect in any type of closing expenses related to refinancing, as these can substantially impact your general savings. By completely computing both month-to-month and lasting cost savings, you can make a notified choice on whether refinancing is a monetarily valuable step for your scenario.

Prepare Needed Paperwork

Having evaluated possible savings, the next action in the refinancing procedure includes gathering the essential documents to promote a smooth application. An efficient collection of documents not only speeds up the authorization procedure yet also improves your reputation as a customer.

Lenders will certainly require proof of income to review your ability to settle the car loan. Furthermore, gather your financial institution statements and any type of financial investment account info, as they provide understanding into your economic health.

Finally, prepare to offer recognition records, such as a vehicle copyright or ticket. Thorough preparation of these materials can dramatically improve the refinancing procedure, making it more effective and much less stressful for you.

Final Thought

In final thought, reliable lending refinancing necessitates a comprehensive strategy that includes recognizing existing lendings, assessing creditworthiness, exploring different refinancing options, and calculating possible cost savings. Careful consideration and tactical planning are extremely important to effective funding refinancing undertakings.

Report this page